Financial Advisor Victoria Bc Can Be Fun For Anyone

Wiki Article

7 Simple Techniques For Investment Representative

Table of ContentsTax Planning Canada Can Be Fun For EveryoneAll about Private Wealth Management CanadaNot known Details About Ia Wealth Management The Ultimate Guide To Private Wealth Management CanadaThe smart Trick of Financial Advisor Victoria Bc That Nobody is Talking AboutIndicators on Investment Consultant You Should Know

Heath is an advice-only coordinator, meaning he doesn’t manage his clients’ money right, nor really does he sell them specific financial loans. Heath claims the selling point of this method to him would be that he doesn’t feel bound to supply some item to solve a client’s money problems. If an advisor is just geared up to sell an insurance-based cure for problems, they may wind up steering some one down an unproductive road inside name of hitting revenue quotas, according to him.“Most monetary solutions folks in Canada, because they’re settled based on the products they feature and sell, they could have reasons to recommend one plan of action over another,” he says.“I’ve chosen this course of motion because I can check my personal customers in their eyes and not feel like I’m using all of them in any way or attempting to make a sales pitch.” Story goes on below advertising FCAC notes how you spend your consultant varies according to the service they supply.

Our Retirement Planning Canada Statements

Heath and his awesome ilk are settled on a fee-only product, which means that they’re compensated like legal counsel might-be on a session-by-session foundation or a hourly assessment price (independent financial advisor canada). According to the variety of solutions and the expertise or common customers of your consultant or coordinator, hourly costs vary for the hundreds or thousands, Heath claimsThis is up to $250,000 and above, he states, which boxes out most Canadian homes out of this degree of service. Story continues below advertisement For those not able to shell out costs for advice-based methods, as well as those hesitant to give up some of the expense returns or without sufficient money to begin with an advisor, you can find less expensive as well as free options available.

The Buzz on Ia Wealth Management

Tale continues below advertisement choosing the best monetary coordinator is a little like matchmaking, Heath claims: you intend to get a hold of someone who’s reputable, provides a character fit and it is the best person for all the period of existence you are really in (http://tupalo.com/en/users/6114064). Some like their particular experts getting earlier with a bit more knowledge, he states, although some prefer some one more youthful who can hopefully stick with them from early years through pension

The smart Trick of Private Wealth Management Canada That Nobody is Discussing

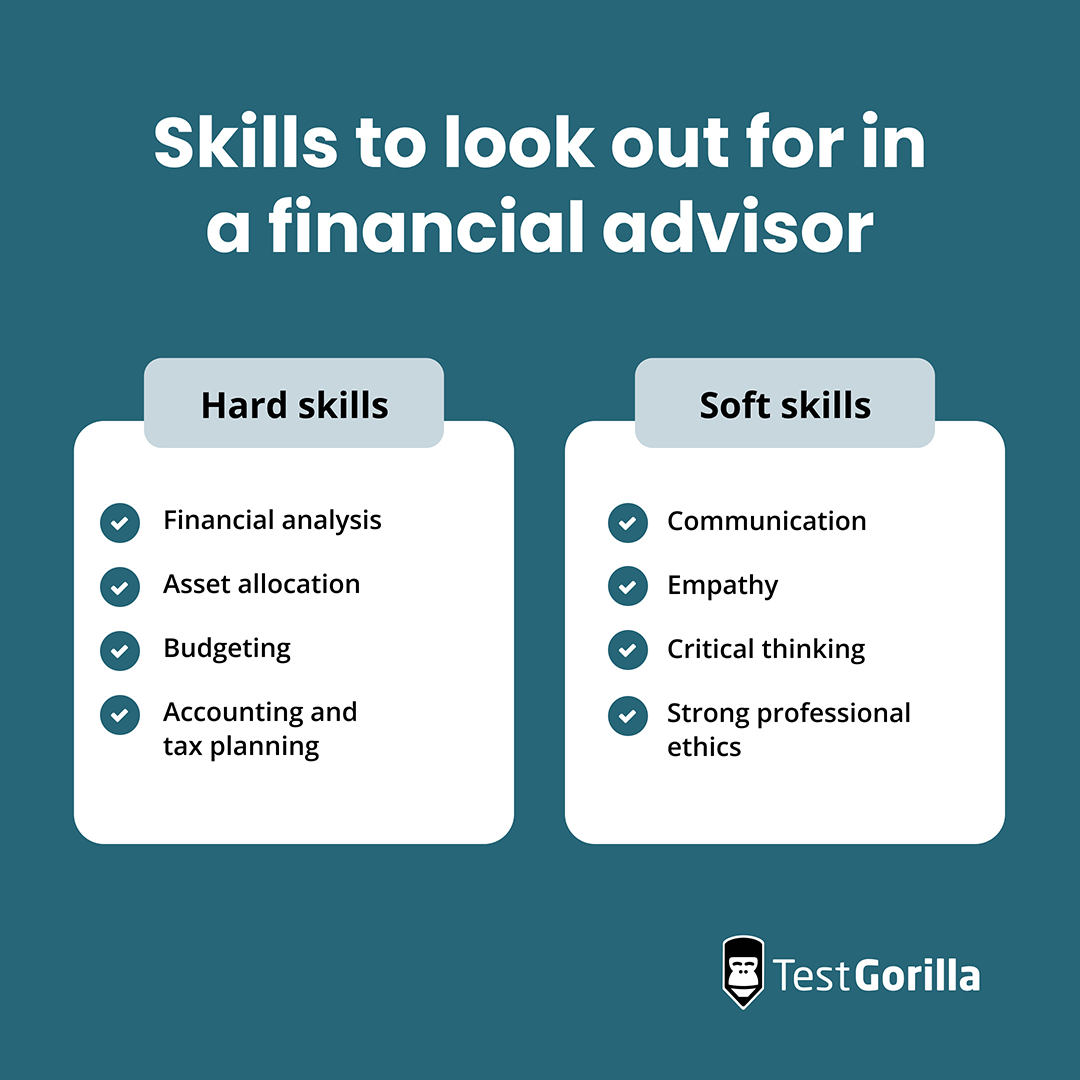

One of the primary errors some body makes in selecting a specialist is certainly not inquiring sufficient concerns, Heath says. He’s surprised when he hears from clients that they’re nervous about inquiring questions and possibly being stupid a trend the guy discovers is just as normal with developed professionals and the elderly.“I’m surprised, since it’s their money and they’re paying many fees these types of people,” he says.“You need getting the questions you have answered therefore have earned for an unbarred and honest union.” 6:11 Investment planning all Heath’s last guidance can be applied whether you’re searching for outdoors monetary support or you’re heading it alone: educate yourself.Listed here are four facts to consider and inquire your self whenever finding out whether you should touch the knowledge of a monetary advisor. Your own internet really worth is not your revenue, but instead an amount which can help you realize exactly what cash you earn, just how much it will save you, and the place you spend some money, as well.

Little Known Facts About Tax Planning Canada.

Your baby is found on just how. The split up is actually pending. You’re approaching retirement. These and various other significant life activities may prompt the requirement to go to with an economic specialist concerning your assets, your financial objectives, and various other financial things. Let’s say your mother kept you a tidy amount of cash in her own will.

You've probably sketched out your own economic strategy, but I have a difficult time sticking with it. A monetary advisor can offer the accountability you need to place your monetary plan on track. In addition they may suggest how exactly to modify the financial program - https://www.abnewswire.com/companyname/www.lighthousewealthvictoria.com_129054.html#detail-tab being maximize the possibility outcomes

A Biased View of Independent Investment Advisor Canada

Anyone can say they’re a monetary specialist, but a consultant with professional designations is actually if at all possible one you really need to employ. more tips here In 2021, approximately 330,300 Us citizens worked as personal monetary experts, based on the U.S. Bureau of Labor studies (BLS). The majority of monetary advisors tend to be self-employed, the agency states - investment representative. Usually, you will find five types of financial advisors

Agents typically obtain income on positions they make. Agents are controlled by the U.S. Securities and Exchange Commission (SEC), the Investment field Regulatory Authority (FINRA) and state securities regulators. A registered expense advisor, either individuals or a company, is much like a registered consultant. Both trade opportunities on behalf of their customers.

Report this wiki page